Risky traders came to life as the dollar fell

Investors who had been shying away from riskier bets celebrated on Thursday as a correction in the value of the U.S. dollar gave them an opportunity to buy assets they had been avoiding.

The dollar’s drop was a relief to investors who have been concerned that the currency’s recent strength would derail a rally in stocks and other risky assets. A weaker dollar makes U.S. assets more attractive to foreign investors and can give a boost to corporate profits when translated back into dollars.

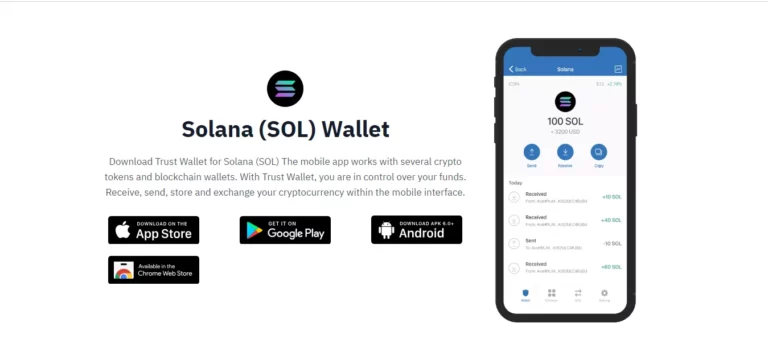

USD has been slumping this week, and that has seen equities build on the bounce over the past few sessions to push for a strong closing period before the weekend hits. US futures are higher and so are European indices as noted here, but we are seeing risk gains extend to cryptos as well. Bitcoin is up over 6% on the day to $20,640 after having been as low as $18,530 during the week.

Elsewhere, the AUD/USD is up over 100 pips and nearing 0.6860 for the day. The buyers are putting up another defense of the key trendline support level on the weekly chart.