A global financial recession has hit. The first financial crisis was started in 2007-2008. It began with market disruptions, and markets suddenly crashed then. In September 2008, Lehman Brothers was a major US financial firm bankrupt.

A global financial recession has hit. The first financial crisis was started in 2007-2008. It began with market disruptions, and markets suddenly crashed then. In September 2008, Lehman Brothers was a major US financial firm bankrupt.

What caused the 2008 financial crisis?

The 2008 Global Financial Crisis marked one of the worst economic crises of our lifetimes, sending stock markets reeling, financial institutions collapsing, and consumers scrambling.

The 2008 global financial crisis had multiple underlying causes that contributed to its onset. One significant factor was the housing market bubble in the US, caused by lax lending standards, risky loan practices and securitized mortgages. Financial institutions packaged mortgage loans into complex financial products known as mortgage-backed securities (MBSs) and collateralized debt obligations (CDOs), which were then sold off to investors worldwide.

However, as the quality of these mortgages declined and borrowers started defaulting on loans, their value decreased rapidly, leading to substantial losses for banks and other financial institutions.

Leverage was widespread among financial institutions, making them even more susceptible to market fluctuations and increasing their vulnerability. Global financial interdependence further compounded this crisis as toxic assets spread throughout it. It caused failures and panic to ensue quickly.

Inadequate regulation and oversight of the financial industry and its lack of transparency and risk evaluation contributed significantly to this crisis. It serves as a stark reminder of the dangers posed by unsustainable lending practices and excessive risk-taking and the necessity of robust regulatory frameworks in maintaining system stability.

Are we ignoring warning signs? An analysis of global economic indicators.

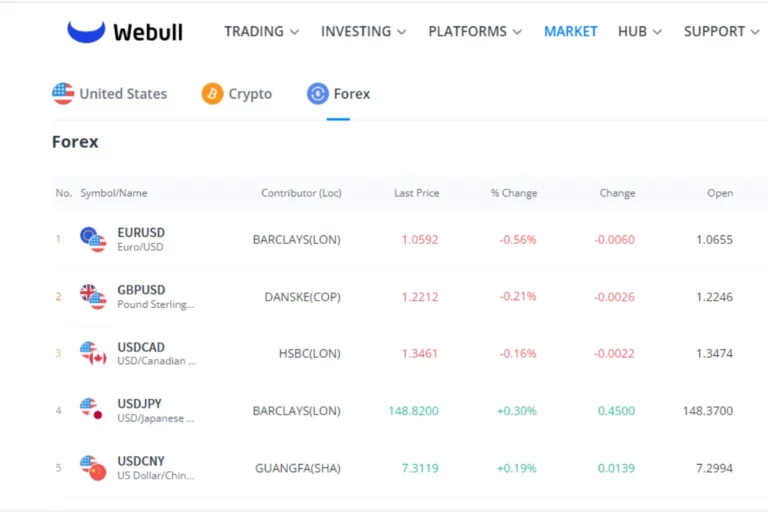

US stocks like US 30, US 100, etc., were up in 2008.Technically, now again, they are on the same static and will fall at any time.Experts believe that the recession could last until the end of 2024.Too many currencies, like NZD, JPY, AUD and USD, are destabilised.

JPYUSD

we observe the JPYUSD chart declining steadily without signs of recovery and no indications for a pullback, it could easily reach the ATL (Time Low), which is currently 0.006576. If it does this, recovery won’t come easy, and further losses might follow.

DJI US30

If we take a look at DJI, which is one of the strongest indexes of America, ranging in the same price for a while

25-05-2023 on fundamental release, DJI temporarily recovers 1.59%.

United States residents witnessed several major banks close within four months, sending shockwaves through the financial system and raising concerns for other institutions’ stability. While future bank collapses cannot be predicted with precision, it’s essential to recognize that the financial sector can be vulnerable due to economic downturns, excessive risk-taking, inadequate regulation, or unexpected events.

XAUUSD

Gold has recently experienced a remarkable uptrend and reached its all-time high (ATH). This remarkable rise can be attributed to several key factors. First and foremost, the financial crisis that began in 2008 created an atmosphere of economic insecurity and risk aversion among investors. At such times, gold is an effective store of value.

Gold’s price tends to increase during financial instability because investors consider it a safe haven asset. When problems such as economic downturns, political unrest, or market fluctuations arise, investors often turn to gold as an asset that provides protection from inflation or instability – an attractive choice given gold’s long history as an inflation hedge and store of value. With increased demand driven by increased investing activity into gold reserves resulting in price spikes, an observed pattern reinforces gold as an ideal option in times of financial crises.